How to Invest in Forex in 10 Questions? The article has been prepared to provide basic information and guidance to those who are considering starting Forex investing. However, it is important to seek support from professional financial advisors before making actual investment decisions.

1. What is Forex and How Does It Work?

Forex, short for “Foreign Exchange,” refers to the global market where different currencies are traded. The Forex market is where investors aim to profit from the movements in currency prices.

2. What Are the Fundamental Concepts?

Before delving into Forex investment, it’s crucial to understand fundamental concepts. Key terms include “lot,” “spread,” “pip,” and “leverage.” Familiarizing yourself with these terms enhances your understanding of market dynamics.

3. Developing an Investment Strategy

Due to the dynamic nature of the Forex market, having a well-defined strategy is essential. Investors can employ various strategies, such as technical analysis, fundamental analysis, or a combination of both.

4. Opening a Demo Account

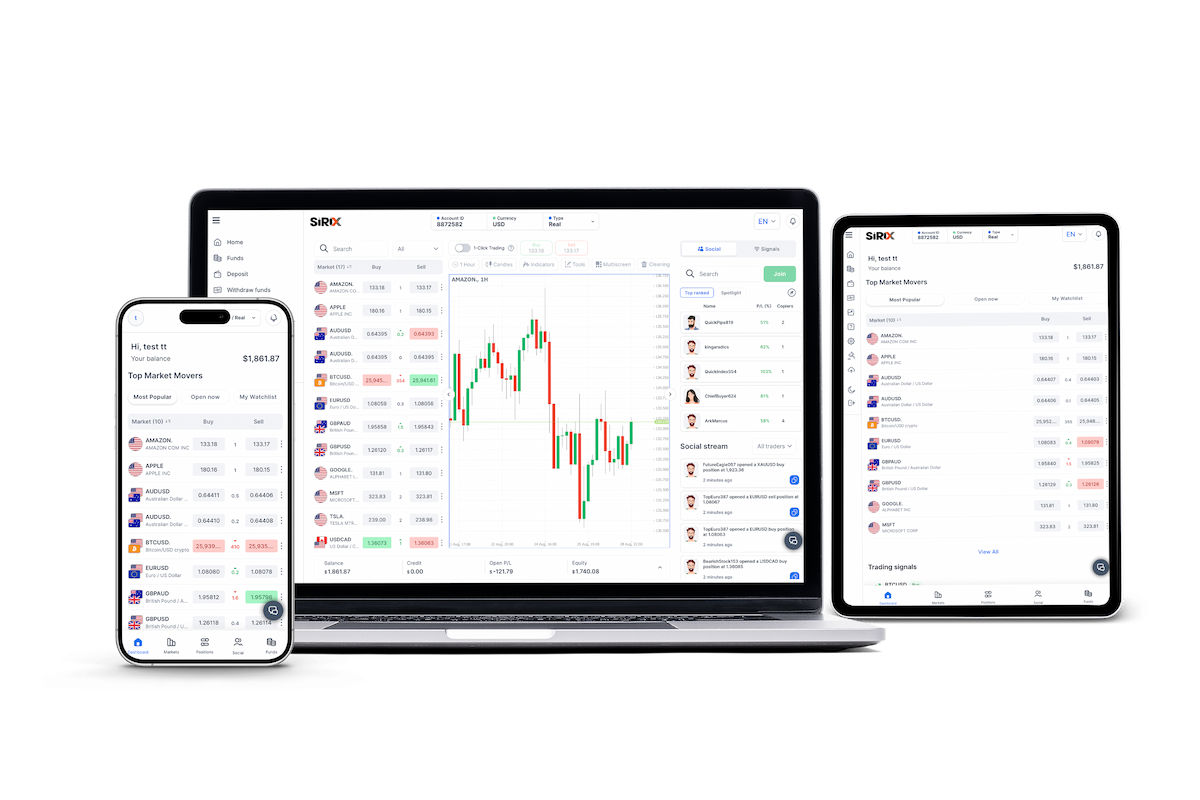

Opening a demo account before committing real funds is an excellent way to understand market dynamics and test strategies. Demo accounts allow you to practice trading in a virtual environment without risking actual money.

5. Risk Management

While the Forex market offers high-profit potential, it also involves high risks. Therefore, effective risk management, including the use of tools like stop-loss orders, is vital to protect your capital.

6. Choosing a Broker

Selecting a reliable broker is crucial for Forex investment. A trustworthy broker should offer low spreads, fast execution, and robust customer support services.

7. Analysis Methods

Success in the Forex market can be achieved through the use of both fundamental and technical analysis. Fundamental analysis focuses on economic indicators and international relations to understand market trends. Meanwhile, technical analysis attempts to predict future price movements using price charts and indicators.

8. Sensitivity and News Monitoring

The Forex market is highly sensitive to global economic events. Monitoring news and examining economic calendars are essential to anticipate market movements.

9. Psychological Preparation

Success in Forex investment requires not only technical and fundamental analysis skills but also emotional control. Being psychologically prepared to react to gains and losses is crucial.

10. Continuous Education and Staying Updated

The Forex market is a constantly changing environment. Investors need to stay informed, follow market trends, and continuously develop new strategies. Education is a significant factor in becoming a successful Forex investor.